Aerospace, Defence & Energy markets

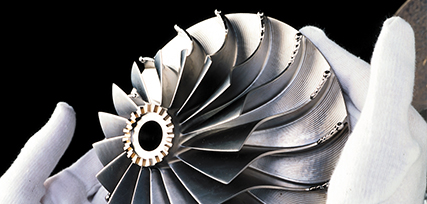

Aerospace and defence revenues improved in 2012 by 17.5% (18.7% at constant exchange rates, of which 13.5% was organic and 5.2% from acquisitions), due to a combination of new contract gains, market share improvement and market demand.

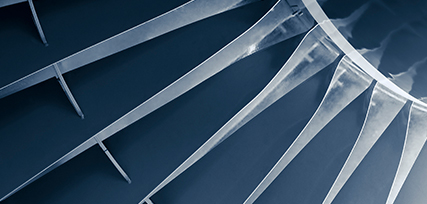

Original equipment sales improved as both Boeing and Airbus continued to increase production rates. Available seat kilometres grew by 3.9% indicating an increase in aircraft flying hours, which in turn drove an increase in demand for aftermarket parts. Sales growth in North America covered most sectors of the aerospace industry but in Europe was primarily due to the supply chain for narrow body aircraft. Sales for engines for wide body aircraft have, as yet, been more muted.

Sales into the defence sector, which account for around 5% of Group sales, were robust with little or no evidence of the downturn reported in the industry finding its way to the platforms that Bodycote serves. Most of the Group's revenues come from the installed equipment base, with a heavy emphasis on applications for US homeland defence.

Power generation sales increased by 3.5% in 2012 (6.3% at constant exchange rates, of which 3.3% was organic and 3.0% from acquisitions) compared to 2011 and would have been higher but for capacity constraints in our US HIP business. Additional capability is due on-stream towards the end of 2013. Once again demand was stronger in North America than in Europe.

Sales to oil & gas customers increased by 21.8% (22.3% at constant exchange rates, of which 15.4% was organic and 6.9% from acquisitions). Much of this growth came from gains in subsea applications and market share wins. Requirements for gas fracking in North America have subsided as the year progressed and this has been exacerbated by inventory correction at the oilfield services companies. The switch from gas fracking to oil provided some mitigation as rigs were made ready for production in a new location.

Automotive & General Industrial markets

In automotive, in the face of reduced demand in all geographies except North America, the Group built on the gains achieved in 2010 and 2011 by offering the broad range of new and traditional processes the sector requires, along with the reliability of service and supply that the extensive network of facilities can offer. Sales to the car and light truck sector declined by 7.1% and to heavy truck by 15.1%.

General industrial revenue performance was mixed by sector and geography. Sales decreased in the year by 0.5%.

In North America automotive revenues improved strongly and for the year as a whole were ahead of 2011 by 25.9% (25.0% at constant exchange rates, of which 5.8% was organic and 19.2% from acquisitions). Car and light truck related sales increased by 23.1% and heavy truck increased by 40.1%. General industrial sales also advanced well and revenues were ahead 25.0% compared to 2011 (23.9% at constant currencies of which 6.5% was organic and 17.4% from acquisitions).

In Western Europe sales were significantly impacted both by reduced demand and currency translation effects due to the weakness of the Euro versus Sterling. Automotive revenues were down 14.5% in 2012 (9.5% in constant currencies, there were no acquisitions). Car and light truck fared better (down 11.8%, 6.0% in constant currencies) than heavy truck, which was lower by 22.6% (19.9% in constant currencies). General industrial sales were much less affected but were, nevertheless, down compared to 2011 by 6.3% (but only 0.6% in constant currencies, there were no acquisitions).

The Group's business in emerging markets had a disappointing year, with sales lower year on year by 13.1% (6.5% at constant currencies, there were no acquisitions). In Eastern Europe weak demand from Germany and France saw our customers reducing their output in Poland and the Czech Republic rather than cut back in their home countries. Asia, notably China for Bodycote, witnessed a short term slow-down in manufacturing activity and Bodycote's business in Brazil was impacted by a significant reduction in industrial activity in 2012.