Reliable performance

Drivetrain components

The automotive industry faces numerous challenges, ranging from consumer driven price and reliability expectations to enhanced environmental and efficiency requirements. Drivetrain components are subjected to high operational loads and can be exposed to extreme environments. The manufacturer's choice of material combined with Bodycote's various processes ensure that every component in the drivetrain operates to design specifications. Many parts are hardened to attain the required strength, whilst others are hardened in local areas prone to wear. Additional procedures can be carried out to provide resistance to corrosion.

Results

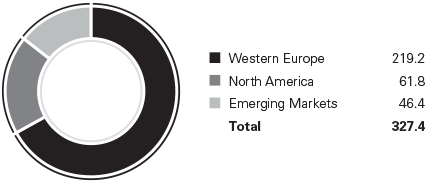

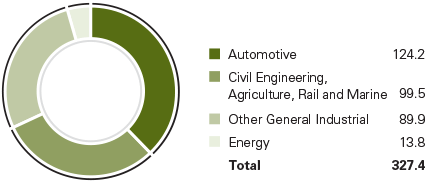

Automotive & General Industrial (AGI) business revenues were £327.4m in 2012, compared to £337.2m in 2011, a decrease of 2.9% (but an increase of 2.2% in constant currencies, made up of an organic decline of 1.6% and an increase from acquisitions of 3.8%).

In 2012 there was a clear difference in demand for the Group's services across the different geographies. North America followed a strong 2011 with a robust 2012 in both automotive and general industrial markets and revenues continued to be enhanced by market share gains. North American revenues grew by 10.5% excluding acquisitions and in constant currencies. In Europe and the emerging markets Group revenues declined by 3.4% (in constant currencies) driven by the weaker macroeconomic conditions particularly in the Eurozone.

Headline operating profit1 in AGI was £43.6m compared to £44.7m in 2011. Despite the reduction in revenues, headline margins remained stable at 13.3% reflecting an improved mix in the business and a prompt reaction in managing costs in geographies where demand levels weakened.

Net capital expenditure in 2012 was £23.0m (2011: £27.0m), which represents 0.8 times depreciation (2011: 0.9 times). In 2013 we expect that capital expenditure will be just above depreciation as we add capacity in China, Mexico and for selected technologies such as S3P, Corr-i-Dur® and Low Pressure Carburising. Return on capital employed in 2012 was 16.3% (2011: 15.6%). The increase reflects continuing focus on improving capital returns by increasingly targeting higher added-value activities. On average, capital employed in 2012 was £267.5m (2011: £286.2m).

Achievements in 2012

The Group has continued to win business across all geographies. In North America our ability to support automotive manufacturers as they move to newer technologies in pursuit of better fuel efficiency has provided Bodycote with market share growth. New outsourcing contracts in Europe and contributions from differentiated technologies such as S3P meant that the revenue declines stemming from the weak economic environment were moderated and margins held up well.

AGI continued to see the benefits of restructuring and market focus. The emphasis on improved efficiency has been a key factor in the achievement of 20% margins in North America and the maintenance of margins in the low teens in Europe in the face of declining revenues.

Organisation and people

At December 2012, the number of full time equivalent employees in AGI was 3,595 (including 415 from acquisitions completed in 2012) compared to 3,423 at the end of 2011 and 1,606 less than its peak in July 2008. AGI revenues of £327.4m compare to £352.7m in 2008 (at 2012 exchange rates) a decrease of 7.2%.

Looking ahead

The AGI divisions will continue to build on their success of enhancing their margins through capturing high value work. The focus on improving customer service helps drive this effort while the prioritisation of existing capacity in favour of higher value work and investing in selected technologies such as S3P, Corr-i-Dur® and Low Pressure Carburising provides additional momentum. In addition the Group will continue with its strategy of adding to its existing footprint in emerging markets, with an emphasis on China and Mexico in the near term.

AGI revenue by geography

£m

AGI revenue by market sector

£m

- Headline operating profit is reconciled to operating profit in note 2 to the consolidated financial statements.