Chairman's message

As Chairman I have taken a leading role in supporting the governance agenda and upholding good principles of corporate behaviour at Bodycote recognising that good governance serves to ensure that the business is run to achieve growth on a controlled and ongoing basis. What I believe are the important governance developments at Bodycote over the last year are detailed in Governance reporting below.

The policy of the Board is to manage the affairs of the Company in accordance with the principles of corporate governance contained in the UK Corporate Governance Code by promoting wide discussions on topics to which Board members contribute and demonstrate mutual engagement. We strive to maintain best practice and continually seek to improve our practices for the benefit of our shareholders.

Alan Thomson

Chairman

| Key actions in 2012 | Priorities for 2013 |

|---|

- Ensure key recommendations from the 2011 strategy review are being implemented

- Board visits to meet the Dutch and Danish teams

- New Non-Executive Director appointed

- External Board training on current topics

| - Implement actions from the 2012 external board evaluation

- Continued focus on management development and succession planning

- New Remuneration Committee Chairman appointed and smooth transition and handover commenced

- Continued emphasis on external Board training

|

Governance reporting

Board diversity

Following the publication of the Davies Report on the representation of women on plc boards, our Nominations Committee discussed its recommendation.

Bodycote is a global business with operations in 26 countries and therefore diversity generally is an integral part of how we do business. The Nominations Committee considers diversity when making appointments to the Board, taking into account relevant skills, experience, knowledge, personality, ethnicity and gender. Our prime responsibility, however, is the strength of the Board and our overriding aim in any new appointments must always be to select the best candidate. We have made progress in addressing the issue of gender and diversity, with the appointment of Eva Lindqvist to the Board as a Non Executive Director on 1 June 2012. As and when we are recruiting new members we would expect to continue to address the issue of gender and ethnicity. Due to the small size of our Board, comprising two Executive Directors and four non-Executive Directors and a non-Executive Chairman, we believe it difficult to set targets or timescales for the percentage of women, or any other group, on our Board and do not propose to set targets for the percentage of women on our Board in future years.

Female representation on our Board is currently 14% and at manager level it is 23%. We will increase female representation on the Board if appropriate candidates are available when Board vacancies arise. Females represent 16% of our total workforce.

Board evaluation

The Board has undertaken its first external Board Evaluation during 2012. Following a review of proposals from five external facilitators, the Board appointed ICSA Board Evaluation to facilitate a review of its performance.

The facilitator Mr Geoffrey Shepheard met with each director on an individual basis to obtain their views on seven aspects of the Board's performance and to ascertain whether their needs and expectations were being met. The evaluator ensured that pre-defined constituent elements of each topic were covered in the discussions and a qualitative score was assigned by each director. The seven topics were as follows:

- Board responsibilities

- Oversight

- Board meetings

- Support for the board

- Board composition

- Working together

- Outcome and achievements

The results of the evaluation were considered by the Board at its meeting in October 2012 and the directors discussed the recommendations which are now in the process of being implemented. Additional emphasis will be placed on risk management and certain operational matters. The approach to Board Evaluation included relevant questions to cover the activities of each Board committee.

The report concluded that the Board was performing well and high governance standards had been adopted. Strong evidence of cohesion and genuine support for colleagues was noted and it was apparent that the Executive is strongly challenged when appropriate.

Arising from the exercise, the Board has concluded that its focus should remain on divisional growth strategies, technology development, risk and sustainability as well as continued training.

The Executive Directors Messrs S.C. Harris and D.F. Landless were appraised internally in January and February 2013.

Led by the Senior Independent Non-Executive Director, the Directors have carried out an evaluation of the Chairman's performance in December 2012. The performance of the other individual Non-Executive Directors was appraised internally by the Chairman.

Training

All new directors receive initial induction training on a diverse range of topics including trading, investor relations, organisational and legal matters. The Board receives training via ad hoc presentations and papers from advisers and the Company Secretary. External periodic training on important topics takes place through the Deloitte Academy and during the year the directors received training on trends in financial reporting, corporate governance and risk management.

Succession planning

Succession planning ensures that appropriate senior leadership resources are in place to achieve Bodycote's strategic objectives. The plans are regularly reviewed by the Nomination Committee.

The Board further develops its knowledge and gains greater visibility of executive talent and management succession by visiting the Group's sites and meeting with key talent and senior executives.

The road map for Non-Executive refreshment continued to be developed in 2012.

Compliance reporting

In respect of the financial year 2012 Bodycote's obligation under the Disclosure and Transparency Rules is to prepare a corporate governance statement with reference to The UK Corporate Governance Code issued by the FRC in June 2010 (the 'Code').

In respect of the year ended 31 December 2012 Bodycote has complied with the provisions of the 2010 Code and has voluntarily adopted most of The UK Corporate Governance Code issued in September 2012 (as reflected in the Report of the Audit Committee), with the exception of provision E1.1. The Board has taken the view that generally it is the responsibility of the Group Chief Executive and the Group Finance Director to manage relationships with institutional investors. The Chairman also meets institutional investors to discuss overall strategy, governance and any concerns that shareholders may have. Only where these more usual channels of communication have failed would the Board expect the Senior Independent or other Non-Executive Directors to become involved, notwithstanding that the 2010 Code specifies attendance of the Senior Independent Non-Executive Director at meetings with major shareholders. Regular feedback by the Company's advisers on investor meetings and results presentations is circulated to all Directors.

Apart from this distinct area, Bodycote was in compliance with the provisions of the 2010 Code throughout 2012.

Operation of the code

Taken together with the Report of the Audit Committee, the Report of the Nomination Committee and the Board report on remuneration presented in the Corporate governance statement, this statement explains how Bodycote has applied the principles of good corporate governance set out in the 2010 Code.

Leadership

The Board is responsible to shareholders for good corporate governance, setting the Company's strategic objectives, values and standards and ensuring the necessary resources are in place to achieve the objectives.

The Board met on nine occasions during 2012, including a specific meeting to review and update the Company's long-term strategy. The Board of Directors comprises seven members, of whom five are Non-Executive Directors and two are Executive Directors, led by the Company's part-time Non-Executive Chairman, Mr A.M. Thomson, who also chairs the Nomination Committee. The Group Chief Executive is Mr S.C. Harris and the Senior Independent Non-Executive Director ('SID') was Mr J. Vogelsang, who chaired the Remuneration Committee until 14 December 2012 and who stepped down as SID at the conclusion of our AGM in 2012. The Audit Committee is chaired by Mr J.A. Biles, who was appointed SID after the conclusion of our AGM in 2012. Ms E. Lindqvist was appointed a Non-Executive Director on 1 June 2012 and was appointed Chairman of the Remuneration Committee as of 14 December 2012. After 10 years of service, Mr J Vogelsang will not stand for re-election at the 2013 AGM. Mr J. Vogelsang stepped down as a member of the Audit and Nomination Committee on 31 December 2011. Brief biographical details of all Directors are given on the Board of Directors page. The Board makes visits to UK sites and overseas facilities during the year. Certain defined powers and issues are reserved for the Board to decide, inter alia:

- Strategy;

- Approval of financial statements and circulars;

- Capital projects, acquisitions and disposals;

- Annual budgets;

- Directors' appointments, service agreements, remuneration and succession planning;

- Policies for financial statements, treasury, safety, health and environment, donations;

- Committees' terms of reference;

- Board and committee chairmen and membership;

- Investments;

- Equity and bank financing;

- Internal control and risk management;

- Corporate governance;

- Key external and internal appointments; and

- Employee share incentives and pension arrangements.

In advance of Board meetings Directors are supplied with up-to-date information regarding the trading performance of each operating division and sub-division, the Group's overall financial position and its achievement against prior year, budgets and forecasts. They are also supplied with the latest available information on safety, health and environmental and risk management issues and details of the safety and health performance of the Group, and each division, in terms of severity and frequency rates for accidents at work.

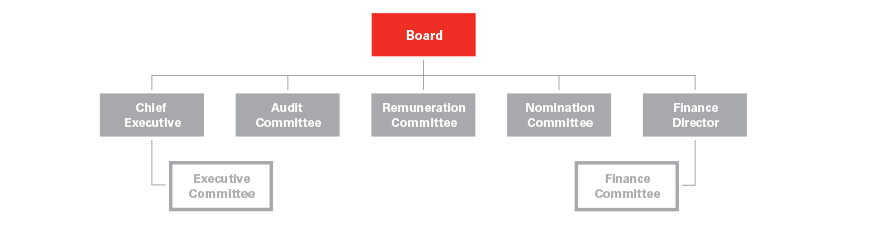

Where required, a Director may seek independent professional advice, the cost of which is reimbursed by the Company. All Directors have access to the Company Secretary and they may also address specific issues to the Senior Independent Non-Executive Director. In accordance with the Articles of Association, all newly appointed Directors and any who have not stood for re-election at the two previous Annual General Meetings, if eligible, must submit themselves for re-election. However, this has been superseded by the Directors' decision to stand for yearly re-election. Non-Executive Directors, including the Chairman, are appointed for fixed terms not exceeding three years from the date of first election by shareholders, after which the appointment may be extended by mutual agreement. A statement of the Directors' responsibilities is set out in the Directors' responsibilities statement. The Board also operates three committees. These are the Nomination Committee, the Remuneration Committee and the Audit Committee.

In accordance with the recommendations of the Code, Board members serve for a period of six years which will only be extended in exceptional circumstances.

So that the necessary actions can be taken promptly, a Finance Sub-Committee, comprising the Chairman (or failing him any other Non-Executive Director), the Group Chief Executive and the Group Finance Director operates between the dates of scheduled Board meetings and is authorised to make decisions, within limits defined by the Board, in respect of certain finance, treasury, tax or investment matters.

Independence of Non-Executive Directors

The Board considers that Messrs J.A. Biles, J. Vogelsang, Dr K. Rajagopal and Ms E. Lindqvist are all independent for the purposes of the Code. During 2013 J. Vogelsang will have served as a Board Director for 10 years and the Board recognises that his tenure has reached a threshold at which his independence could be called into question. However, given the importance of the experience and skills required to perform the role of Chair of the Remuneration Committee, J. Vogelsang remained as Chair of the Remuneration Committee until 14 December 2012, when E. Lindqvist took over as Chair. J. Vogelsang will be a Board Director until the 2013 AGM, at which time he will not stand for re-election.

Commitment

Attendance of Directors at regular scheduled meetings of the Board and its Committees is shown in the table below:

| | Full Board | Audit Committee | Remuneration

Committee | Nomination

Committee |

|---|

| Director | Eligible | Attended | Eligible | Attended | Eligible | Attended | Eligible | Attended |

|---|

| A.M. Thomson | 9 | 9 | – | – | 7 | 7 | 4 | 4 |

| S.C. Harris | 9 | 9 | – | – | – | – | 4 | 4 |

| J. Vogelsang | 9 | 9 | – | – | 7 | 7 | – | – |

| J.A. Biles | 9 | 9 | 4 | 4 | 7 | 7 | 4 | 4 |

| K. Rajagopal | 9 | 9 | 4 | 4 | 7 | 7 | 4 | 4 |

| E. Lindqvist* | 6 | 5 | 2 | 2 | 4 | 4 | 2 | 2 |

| D.F. Landless | 9 | 9 | – | – | – | – | – | – |

* Appointed on 1 June 2012

All Directors attended the maximum number of scheduled Audit, Remuneration and Nomination Committee meetings that they were scheduled to attend. All Directors attended the maximum number of scheduled Board meetings with the exception of E. Lindqvist, who did not attend the September meeting due to commitments in place prior to her appointment. In addition, where not a member, Messrs Thomson, Harris, Vogelsang and Landless attended by invitation the whole or part of some of the meetings of the Audit, Nomination and Remuneration Committees.

Proposals for re-election

The Board decided, in line with the Code, that all Directors will retire annually and, other than in the case of any Director who has decided to stand down from the Board, will offer themselves for re-election at the Annual General Meeting. Accordingly Messrs A.M. Thomson, S.C. Harris, D.F. Landless, J.A. Biles and Dr K. Rajagopal will stand for re-election, and Ms E. Lindqvist having been appointed by the Board on 1 June 2012 will stand for election. After 10 years of service, Mr J. Vogelsang will not stand for re-election at the 2013 AGM. The Board recommends to shareholders that they re-elect or elect all the Directors. In accordance with the recommendations of the Code, Board members will serve for a period of six years which may be extended in exceptional circumstances.

The performance of each Director was evaluated as indicated above and the Board confirms in respect of each that their performance continues to be effective and that each continues to demonstrate commitment to his or her respective role.

Internal control and risk management

The Board is responsible for the Group's system of internal control and for reviewing its effectiveness. Such a system is designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable and not absolute assurance against material misstatement or loss. The Board has applied Principle C.2 of the Code by establishing a continuous process for identifying, evaluating and managing the Group's significant risks, including risks arising out of Bodycote's corporate and social engagement. The Board continuously and regularly reviews the process, which has been in place from the start of 2000 to the date of approval of this report and which is in accordance with Internal Control: Guidance for Directors on the Combined Code published in September 1999 and with revised guidance on internal control published October 2005. The Board's monitoring covers all controls, including financial, operational and compliance controls and risk management systems. It is based principally on reviewing reports from management and from internal audit to consider whether any significant weaknesses are promptly remedied and indicate a need for more extensive monitoring. The Audit Committee assists the Board in discharging these review responsibilities.

The Group prepares a comprehensive annual budget which is closely monitored and updated quarterly. The Group's authority matrix clearly sets out authority limits for those with delegated responsibility and specifies what can only be decided with central approval.

The Internal Audit department monitors the Group's internal financial control system and its reviews are conducted on the basis of plans approved by the Audit Committee, to which Internal Audit reports are submitted on a regular basis.

Every Bodycote site provides assurance on specified financial and non-financial controls through a control self assessment process. The results are validated by Internal Audit through spot checks and are reported to the Audit Committee. In addition the President and the Vice President of Finance of each Division sign a letter of Representation annually.

During 2012, in compliance with provision C.2.1, management performed a specific assessment for the purpose of this Annual Report. Management's assessment, which has been reviewed by the Audit Committee and the Board, included a review of the Group's key strategic and operational risks, which is summarised from work performed by VP of Risk and the Group's Risk Committee to identify risks (by means of workshops, interviews, investigations and by reviewing departmental or divisional risk registers). The risks identified were assessed using conventional impact and likelihood scoring (both before and after mitigating actions), and further assessment, monitoring and review work was carried out in 2012. The Group's risk management framework is progressively being embedded throughout the Group. The principal risks and uncertainties affecting the Group are shown in Principal risks and uncertainties. No significant previously unidentified risks were uncovered as part of this process, and the necessary actions have been or are being taken to remedy any significant failings or weaknesses identified as part of the reviews.

Investor relations

The Group Chief Executive and Group Finance Director regularly talk with and meet institutional investors, both individually and collectively, and this has enabled institutional investors to increase their understanding of the Group's strategy. Makinson Cowell undertook an investor audit and presented the views of shareholders to the November Board. During the year the Chairman met separately with three of the five largest shareholders to discuss governance matters. The business of the Annual General Meeting comprises a review of the Group's operations for the benefit of shareholders attending. In addition, internet users are able to view up-to-date news on the Group and its share price via the Bodycote website at www.bodycote.com. Users of the website can access recent announcements and copies of results presentations and can enrol to hear live presentations. On a regular basis, Bodycote's financial advisers, corporate brokers and financial public relations consultants provide the Directors with opinion surveys from analysts and investing institutions following visits and meetings with the Group Chief Executive and Group Finance Director. The Chairman and Senior Independent Non-Executive Director are available to discuss any issues not resolved by the Group Chief Executive and Group Finance Director. On specific issues, such as the introduction of long-term incentive and share matching schemes in 2006 and changes thereto in 2009 and 2010, the Company has sought and will continue to seek the views of leading investors.

By order of the Board:

U.S. Ball

Secretary

27 February 2013

Springwood Court

Springwood Close

Tytherington Business Park

Macclesfield

Cheshire

SK10 2XF